Questions emerged this week over whether Prime Minster Anthony Albanese might seek changes to two contentious housing policies: , and the capital gains tax discount.

Sparked by reports on Wednesday that Treasury had been asked to model modifications, Albanese’s response to the speculation has changed. He first said he “didn’t know” if Treasurer Jim Chalmers had asked for the examination before Labor taking changes to the next federal election.

“No, we’re not,” Albanese said when asked by ABC News Breakfast on Thursday if his party would seek to do so.

But when asked about potential changes again on Friday, Albanese was not so definitive, saying “what we are doing is what we have before the parliament” and pointing to his party’s Help to Buy and Build to Rent schemes which .

Albanese says these policies will help put downward pressure on home prices by improving supply but the Greens, which have opposed the changes in the upper house, argue they won’t. They have

And speaking from China, Chalmers signalled he had asked Treasury for the modelling saying it wasn’t “unsual” for governments to get advice on “contentious issues” and that such changes weren’t part of Labor’s existing “ambitious housing policy”.

Many have drawn comparisons to the language, with Albanese’s reluctance to directly rule out property investment breaks at the next election fuelling debate.

Experts agree that solving Australia’s housing crisis needs a multi-faceted approach.

So, can reforming concessions such as negative gearing and the capital gains tax discount be part of the solution?

What are negative gearing and capital gains tax discounts?

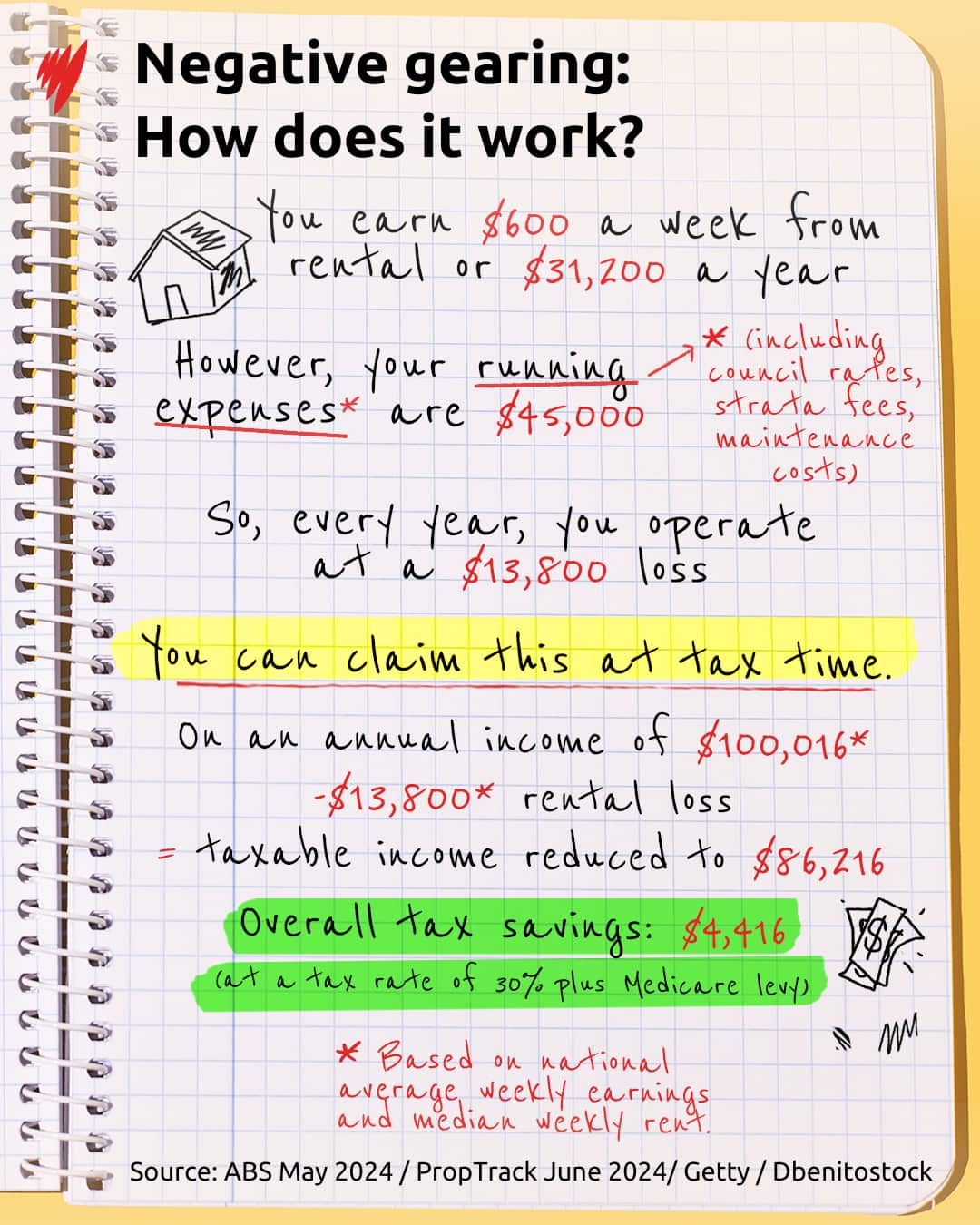

AMP chief economist Shane Oliver described negative gearing as the ability of an investor to offset any income from an investment against any losses or costs involved in maintaining it.

That means if your mortgage and operating costs — including strata fees, council rates, and maintenance — exceed the rental income of a property, you can offset this against your taxable income and pay less tax.

The capital gains tax (CGT) discount works differently, as it is applied when you sell an asset like a house after owning it for at least 12 months.

You can claim a 50 per cent tax discount on any profit made from the sale of assets, which include stocks, bonds, jewellery and real estate.

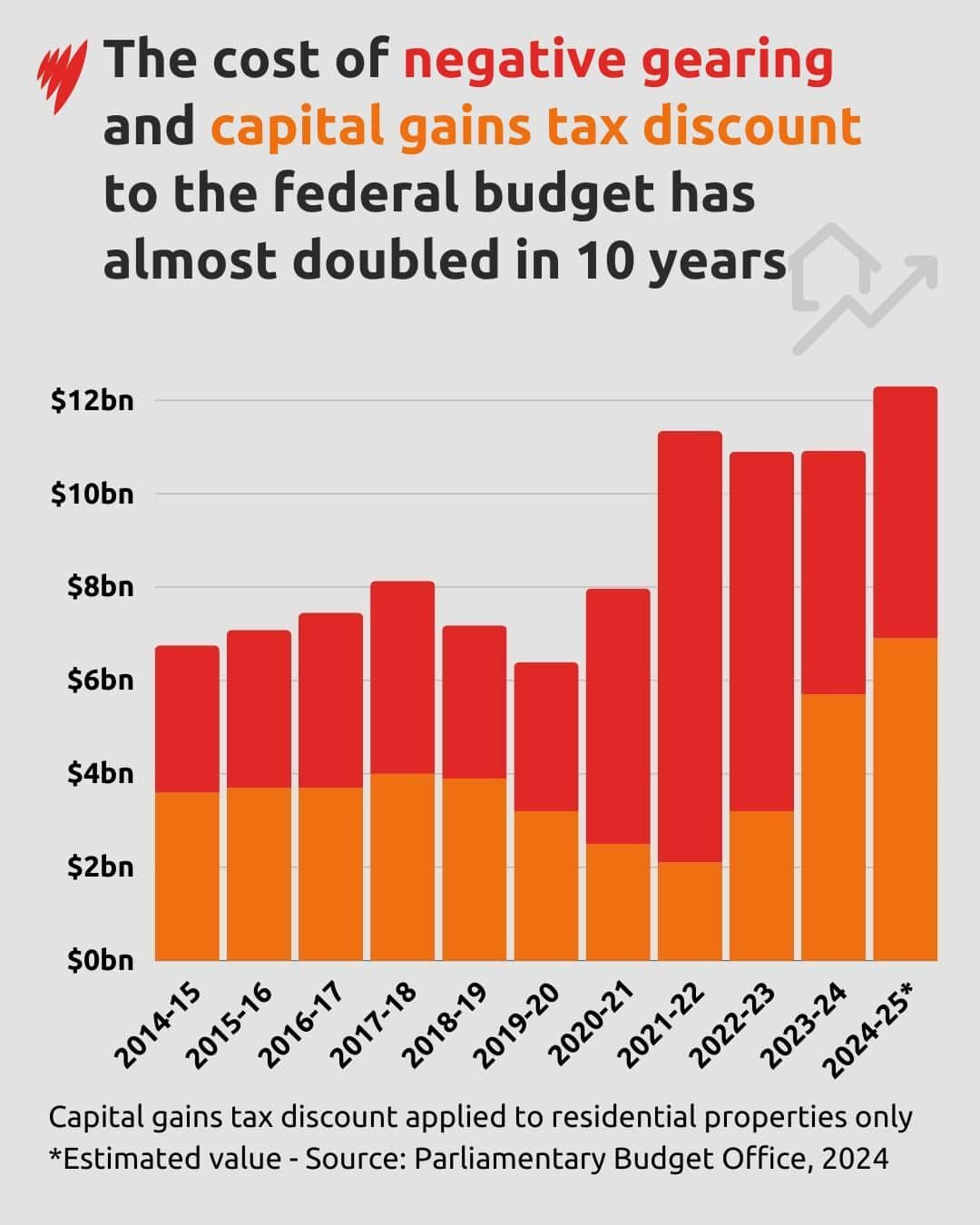

A Parliamentary Budget Office analysis in June revealed that the tax revenue foregone as a result of these two concessions had risen from $6.7 billion in the 2014-15 financial year to $10.9 billion in the 2023-24 financial year. That figure is expected to be $12.3 billion in 2024-25.

The cost of negative gearing and the capital gains tax discount to the federal budget is expected to be more than $12 billion in the next financial year. Source: SBS News

Some experts argue these schemes make it lucrative for investors to buy more properties, driving up house prices.

While Oliver said the CGT discount is the “biggest distortion in the tax system”, he said: “We’re dramatically undersupplying properties to the market [compared] to what we should be doing given the population growth”.

Can changes to property concessions impact housing supply?

Last week, Albanese said changes to negative gearing could hurt the housing supply, pointing to a report by the Property Council of Australia which concluded it would reduce the number of homes built.

Oliver agrees that while reform could be positive in the short term, it would impact housing supply in the long term.

“Initially reducing [investor] concessions could actually lower property prices as investors exit the market, less demand from investors basically,” he told SBS News.

“Longer term I think it would be a problem because less investors would mean a lesser supply of rental property, which could mean higher rents.”

A ‘Fix The Housing Crisis’ rally in Sydney last year. Australia remains in a housing affordability crisis. Source: Getty / Lisa Maree Williams

He said it would also drive more people into the market, leading to higher property prices.

However, housing advocacy group Everybody’s Home disagrees it’s a supply issue, blaming a lack of affordable housing which it says has been exacerbated by the concessions.

“Supply is going up and up and up, affordability is going down and down,” spokesperson Maiy Azize said.

“[The] uptake of these tax concessions is going up and government provision of housing is going down.”

Where do political parties stand?

Opposition leader Peter Dutton called on Albanese to “get out and argue the case” to make changes, as he ruled them out.

“Well, our policy is no change and we give that absolute guarantee,” Dutton told radio 2GB on Thursday.

“We’re not going to wreck the economy through a policy that’s advocated by the Greens.”

The Greens continue to advocate for the scrapping of , with the saved revenue to be set aside for public housing, and are pushing for a rent freeze and a cap on rents.

Labor is nervous about revisiting changes after unsuccessfully campaigning on the issue at the 2016 and 2019 elections.

Ahead of the 2019 election, then-Labor leader Bill Shorten proposed limiting negative gearing to new properties and reducing the capital gains tax concessions from 50 per cent to 25 per cent.

Independent senators David Pocock and Jacqui Lambie, to negative gearing and the CGT discount, commissioned Parliamentary Budget Office research on multiple scenarios to change these concessions.

They have put forward what they say is a “sensible middle path” that could save up to $16 million over the next decade and be reinvested into social and affordable housing projects.