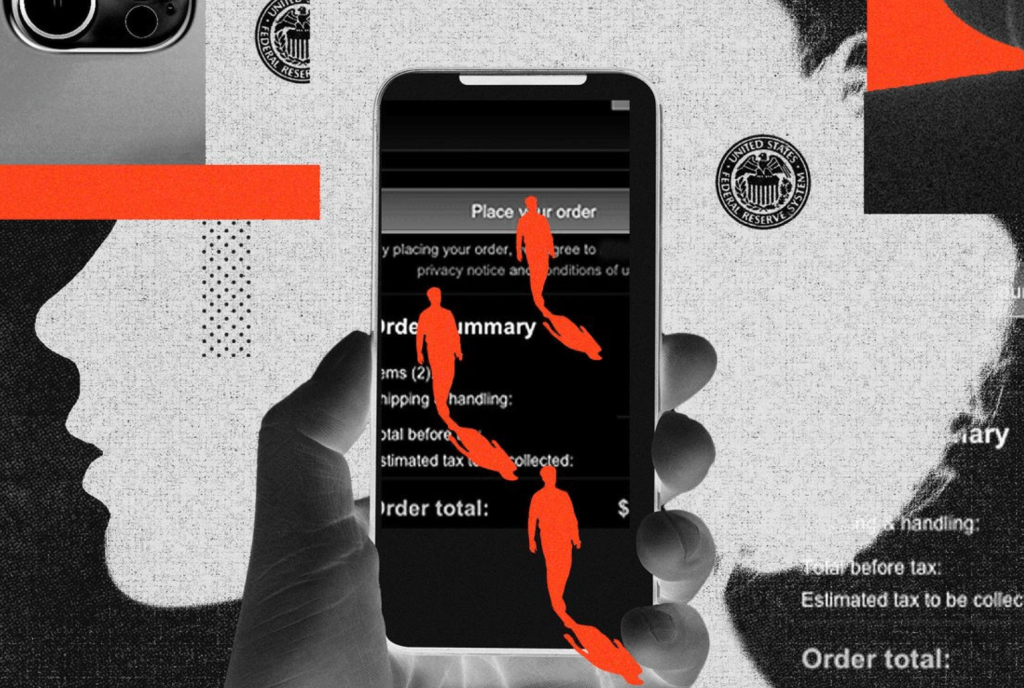

Clumsy scam emails are easy to spot. New AI aided scams are much more convincing.

The Wall Street Journal reports AI Is Helping Scammers Outsmart You—and Your Bank. This is a free link.

Artificial intelligence is making scammers tougher to spot.

Gone are the poorly worded messages that easily tipped off authorities as well as the grammar police. The bad guys are now better writers and more convincing conversationalists, who can hold a conversation without revealing they are a bot, say the bank and tech investigators who spend their days tracking the latest schemes.

ChatGPT and other AI tools can even enable scammers to create an imitation of your voice and identity. In recent years, criminals have used AI-based software to impersonate senior executives and demand wire transfers.

“Your spidey senses are no longer going to prevent you from being victimized,” said Matt O’Neill, a former Secret Service agent and co-founder of cybersecurity firm 5OH Consulting.

In these recent cases, the frauds are often similar to old scams. But AI has enabled scammers to target much larger groups and use more personal information to convince you the scam is real.

Fraud-prevention officials say these tactics are often harder to spot because they bypass traditional indicators of scams, such as malicious links and poor wording and grammar. Criminals today are faking driver’s licenses and other identification in an attempt to open new bank accounts and adding computer-generated faces and graphics to pass identity-verification processes. All of these methods are hard to stave off, say the officials.

JPMorgan Chase has begun using large-language models to fight identity fraud. Carisma Ramsey Fields, vice president of external communications at JPMorgan Chase, said the bank has also stepped up its efforts to educate customers about scams.

Password risks, amplified

Criminals used to have to guess or steal passwords through phishing attacks or data breaches, often targeting high-value accounts one by one. Now, scammers can quickly cross-reference and test reused passwords across platforms. They can use AI systems to write code that would automate various aspects of their ploys, O’Neill said.

If scammers obtain your email and a commonly used password from a tech company data breach, AI tools can swiftly check if the same credentials unlock your bank, social media or shopping accounts.

That’s the lead-in to the WSJ article. The link above is a free link.

Kudos to the Journal for offering free links. I try to be fair about what I use. Very few of my references to the Journal are free links.

The Financial Times threatened me if I ever used more than one sentence from an article, even a rebuttal.

I responded by cancelling my subscription and have never referred to a FT article again. I fail to see how the FT thinks it gains from this.

Consider this a public service announcement courtesy of the Wall Street Journal.

Thanks