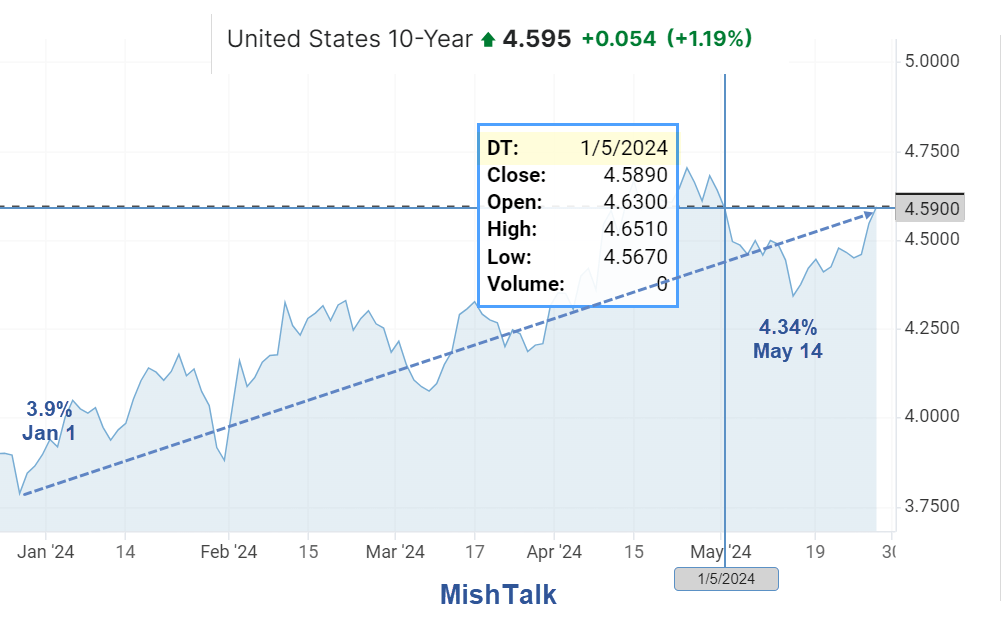

It’s been a tough year for US Treasury bulls. The rally that began in late April on hopes of Fed rate cuts is mostly gone. The continued rally into May is gone.

Yield on the 10-year treasury is 4.59 percent on May 29, right where it started the month. A quarter-point rally on hopes of rate cuts vanished today.

Yields are still lower than the 2024 intraday peak of 4.74 percent, but they are nearly 70 basis points higher than the start of the year as rate cut after rate cut hopes keep getting priced out.

No Need to Hurry Rate Cuts

Minneapolis Federal Reserve President Neel Kashkari says he wants to see “many more months” of positive inflation numbers before interest rates start to come down — and refused to rule out a rate hike if needed.

Comments like those are taking a toll. Yet the economy has been weakening.

Confused?

New Home Sales Huge Negative Revisions

New Home Sales plunged in April. And the Census Department completely revised away the fictional 8.8 percent rise in March.

For discussion, please see New Home Sales Sink 4.7 Percent on Top of Huge Negative Revisions

Discretionary Spending Tumbles at Target

On May 22, I noted Discretionary Spending Tumbles at Target, Shares Drop 10 Percent

Target CEO Brian Cornell said the results show “continued soft trends in discretionary categories.”

The interesting word above is “continued”.

EVs Hit Brick Wall

The Inflation Reduction Act provided stimulus for a while, but it also caused the auto manufacturers to gear up for cars that few want now.

EVs have hit a brick wall. IRA stimulus has gone into reverse.

On April 2, I commented Tesla’s Deliveries Drop for First Time Since 2020, It’s Demand Not Supply

On April 15, I noted Elon Musk Fires 10 Percent of Tesla Workforce, Prepares for “Next Phase of Growth”

On April 26, I noted Ford Loses $132,000 on Each EV Produced, Good News, EV Sales Down 20 Percent

And repetitive minimum wage hikes are now pressuring restaurants into layoffs.

The Fed’s Big Problem

On February 20, 2024 I noted The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

Those renting and looking to buy a home are very angry at rent prices up at least 0.4 percent for 32 straight months while home prices are the least affordable in history.

No one wants to trade a 3.0 percent mortgage for a 7.5 percent mortgage so the housing market is essentially locked up.

Is the US in Recession Now? Two Prominent Competing Views

Housing is locked up, EVs are a disaster, consumer spending is weakening, and some think a recession has already. started.

Yet, here we are.

For discussion, please see Is the US in Recession Now? Two Prominent Competing Views